Westlake MUD 1 adopts new, lower tax rate for 2019

Posted on October 30, 2019 | 2 min read

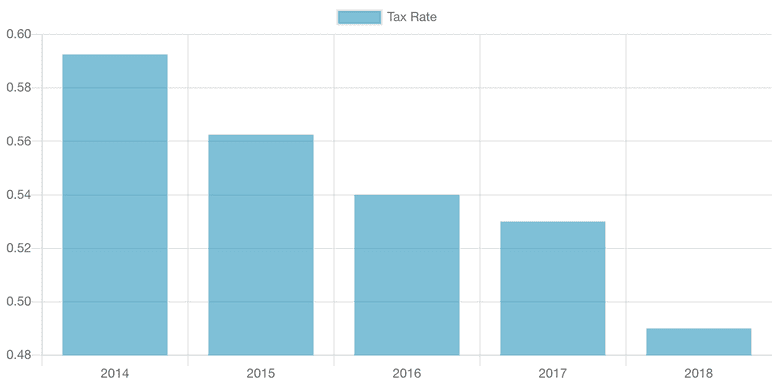

The Westlake Municipal Utility District No. 1 Board of Directors adopted a tax rate of $0.48 per $100 in property value for the 2019 tax year at their September 23 regular meeting.

The new rate, which is a reduction of $0.01 per $100 property valuation from 2018’s rate of $0.49 per $100 valuation, was adopted unanimously by the Board’s five members. The Board was able to reduce the rate in part because of increased property values in the District. This rate will reduce tax bills by $10 per $100,000 in home value as compared to the prior year for the District’s portion of residents’ property tax bills.

With the new $0.48 per $100 valuation tax rate, the District has lowered its tax rate by more than 11 cents since 2014. This is a savings of $10 per each $100,000 of property value for homes located in the District.

Westlake MUD 1 also offers a $25,000 tax exemption for disabled residents and residents 65 years of age and older. More information regarding how to apply for the tax exemption can be found by contacting the Harris County Tax Assessor-Collector and the Harris County Appraisal District. Further guidance can be found by reaching out to a licensed tax professional.

Both the recently adopted tax rate and the increased tax exemption - it was $15,000 for the prior tax year - will be reflected on property owners’ tax bills in 2020 for the 2019 tax year.

Did you find this article helpful? Please share with your neighbors to help keep them informed by clicking the social media links on this page.